The Basic Principles Of Cryptocurrency – News, Research and Analysis – The

Cryptocurrency by Jeffrey Mayer - Audiobook - Audible.com

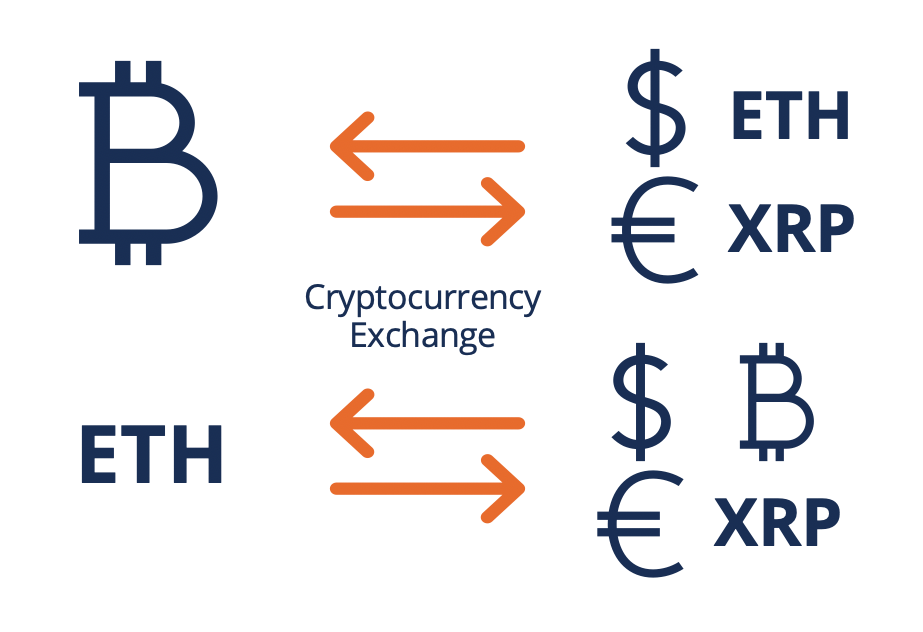

Kraken: Bitcoin & Cryptocurrency Exchange - Bitcoin Trading Can Be Fun For Everyone

The credibility of each cryptocurrency's coins is provided by a blockchain. A blockchain is a continually growing list of records, called blocks, which are connected and secured utilizing cryptography. Each block normally includes a hash pointer as a link to a previous block, a timestamp and deal data. By style, blockchains are naturally resistant to modification of the information. It is "an open, dispersed ledger that can record transactions in between two celebrations effectively and in a proven and permanent way". For This Author as a dispersed ledger, a blockchain is normally handled by a peer-to-peer network jointly adhering to a procedure for validating new blocks.

Blockchains are protected by design and are an example of a distributed computing system with high Byzantine fault tolerance. Decentralized agreement has therefore been accomplished with a blockchain. Cryptocurrencies utilize numerous timestamping plans to "prove" the validity of deals added to the blockchain ledger without the requirement for a trusted third celebration. The very first timestamping scheme invented was the proof-of-work plan. The most extensively used proof-of-work plans are based upon SHA-256 and scrypt. Some other hashing algorithms that are used for proof-of-work consist of Crypto, Night, Blake, SHA-3, and X11. The proof-of-stake is an approach of securing a cryptocurrency network and achieving distributed agreement through requesting users to reveal ownership of a particular quantity of currency.

2020 Global Challenges for Cryptocurrency - Global Trade Magazine

The scheme is mostly reliant on the coin, and there's presently no standard kind of it. Some cryptocurrencies use a combined proof-of-work and proof-of-stake scheme. In cryptocurrency networks, mining is a validation of deals. For this effort, successful miners acquire new cryptocurrency as a benefit. The benefit reduces transaction costs by producing a complementary reward to add to the processing power of the network. The rate of producing hashes, which validate any deal, has been increased by the use of specialized makers such as FPGAs and ASICs running complex hashing algorithms like SHA-256 and scrypt. This arms race for cheaper-yet-efficient devices has existed since the day the very first cryptocurrency, bitcoin, was introduced in 2009.